What is A Repair Mortgage Loan?

Any time you could create your ideal room, what can they resemble?

If you are like most individuals, you had choose property that expresses your own personal preferences. Whether that includes contemporary, high-end does, solid-surface counter tops, or a shower that feels as though a rain forest, the choice is actually your own.

What exactly are your dreaming of?

Whenever you can dream they, you can also find ways to fund it.

Here’s how it normally goes: you order a fixer higher for outstanding rate with a plans of how youare going to put some perspiration money engrossed and change it into the homes you dream about. This needless to say means you have to discover time and energy to do the efforts (good-bye evenings and vacations), inquire about help should you decide aren’t a creator or perhaps helpful with technology, select the finances to cover it (bank cards, shop credit, extra cash, house assets financing), and keep carefully the excitement of dream lively through the entire entire ordeal.

Or you could bring a remodelling mortgage. This option allows you to have the funds had a need to buy the belongings AND the resources you should make the renovations/repairs on the quarters. And it is all folded upwards into one home loan with inexpensive monthly obligations. Just like vital, possible buy a professional doing the task and also to get it done on time.

With rates of interest where they’ve been for the last four years, for each $1,000 your roll into the mortgage, you’ll only pay about $6 more monthly on your residence repayment.  So if you want a $20,000 kitchen area update, you can plan for around $120 considerably each month. Not bad at all!

So if you want a $20,000 kitchen area update, you can plan for around $120 considerably each month. Not bad at all!

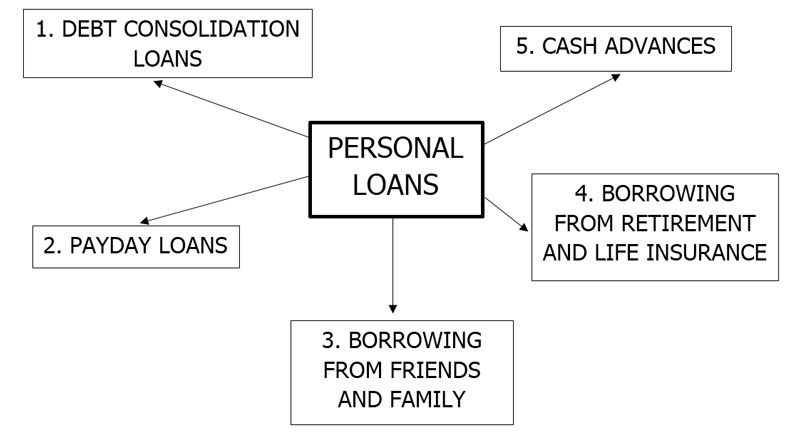

What exactly are my personal restoration financing choices?

You have got a few alternatives for financing your ideal home renovating project. Here’s a glance at certain well-known choices:

The FHA 203(k) financing were essentially the exact same goods, with differing needs or allowable maintenance. With this loan, you are able to use as much as 96.5% associated with appraised price – according to the worth after advancements or repair works were completed – to get (or refinance) property and completed the building work.

There are some key differences when considering the 2: the restricted 203(k) does not cover architectural fixes. Such a thing architectural has to be bumped for the common 203(k). In addition, the conventional 203(k) calls for a HUD specialist on the financing. This individual draws within the documents and works closely with the consumer as well as their technicians to get a write-up ahead of the appraisal (we could place you touching a HUD consultant). The Limited 203(k) does NOT require a HUD expert. Last but not least, there’s an expense improvement. The permitted price of remodeling for the brief 203(k) try $35,000 maximum. In case your fixes and restorations exceed $35,000 then you will want to find yourself in a general 203(k) loan.

Using HomeStyle restoration mortgage, you should buy a house and remedy it upwards or re-finance your financial and enjoy resources to cover the expense of fixes, remodeling, building work or energy conserving modifications on the home.

With a 10% advance payment you can add your own preferences and magnificence to a home making it your house with remodeling works like a fresh home, restroom, space addition or energy efficient updates.

As you can see, renovation financial loans tends to be a fantastic appliance to assist you reach your desired homes. Thus go-ahead, start thinking about those newer home cupboards, complimentary appliances (for once!) and granite countertops.

When you’re ready to plan your own renovating or remodelling task, pick your regional Amerifirst branch or pertain web , and somebody from your Renovation team will be happy to sit down and talk about the opportunities.

0 responses on "Amerifirst blogs. Explore all of our blog for knowledge on shopping for, funding, renovating, and looking after your residence."